Right now it seems the marketing and advertising world is changing in so many ways, largely affected by real-time developments like AI tools, legacy platforms evolving, and more thoughtful ways to build community.

One thing that hasn’t changed is brands are still seeking innovative ways to reach new audiences. For this blog post, we’ll discuss how to lean into emerging spaces in sports to develop more dynamic relationships.

By partnering with athletes, teams, or events, brands can tap into the passion and loyalty of sports fans, and connect with audiences in a more emotional and memorable way.

New Opportunities with College Athletes

Ideal for small to medium size budgets reaching younger audiences

The college sports audience has a diverse age range of fans. From loyalist Boomers who still attend homecoming games every year to Gen Z fans starting to join in their parents or older sibling’s alma mater traditions. During season, these fans have a high frequency of touch points that lends itself to social interactions (ex. Watching in groups).

As of July 1, 2021, it became legal for college athletes to have NIL (Name Image Likeness) deals – allowing them to accept sponsorships and receive compensation for companies using them in campaigns.

This created a new space for brands to leverage within the long-standing industry.

- College athletes are still students with active social lives and a “live-in” audience base on college campuses. This proximity allows for opportunities to engage fans and nurture the fandom.

- Similar to professional athletes, fans are invested in following during games and in their personal time – curious about what they’re eating, what shampoo they use, or other seemingly mundane information. Being able to access these details supports the notion that these athletic stars are”just like them.”

- With the wide range of college level athletes, brands can be creative with smaller budgets or split larger ones across a few names in different geographic markets.

Deeper dive: We looked at Aliyah Boston – the star player on the #1 college women’s basketball team for the last two years.

- Boston is activating partnership content on Tiktok and Instagram, with an average 247 comments per post and 12K likes.

- The success of her team could mean even higher visibility of Aliyah’s channels and the brands she chooses to partner with.

- As Aliyah’s continues to grow in her career, brands have a chance to “grow with” an athlete likely to be drafted to the WNBA.

- Recent NIL deals for Aliyah include…

- European Wax Center

- Orange Theory Fitness where she created her own workout

- Six Star Pro Nutrition, including a giveaway to College Basketball Championship weekend

- Crocs

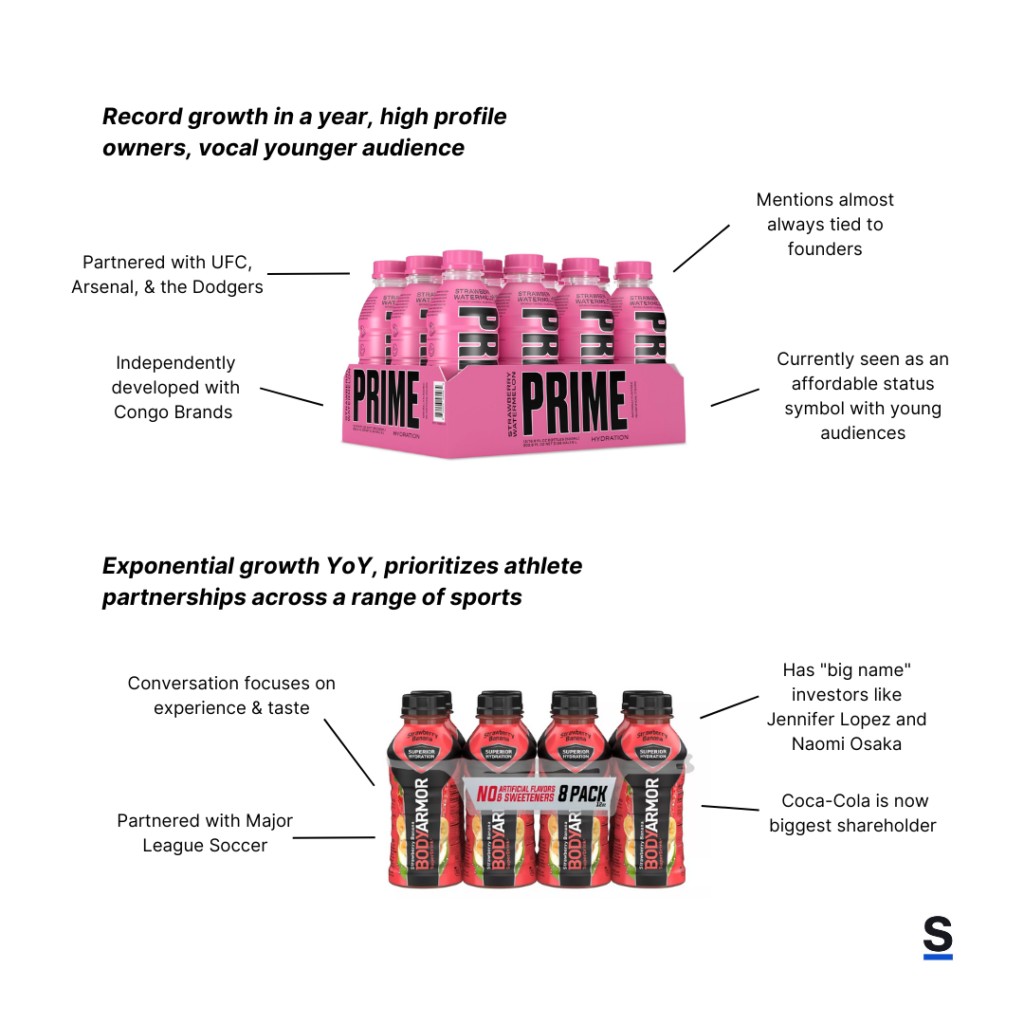

Body Armor and PRIME – two different beverage brands driving reach in different ways

Ideal for large size budgets trying to reach multiple audience clusters

Last year the sports drink market was valued at 24.4 billion and expected to be over 30 billion in the next five to six years. These ready-to-drink beverages can be found almost anywhere – at convenience stores, gyms, gas stations, and grocery establishments. When diehard sports fans are watching their favorite athletes or fitness creators on social media, they’re paying attention to what they’re drinking before and after the game.

To get a closer look, we assessed two well-known brands and the volume of conversation around key partnerships.

Body Armor is a brand well-known for its collaboration with a range of athletes. There’s a page on their site dedicated to them and big names who have invested in the brand. Officially a Coca-Cola beverage, Body Armor seems well-positioned to overtake Powerade should the sports category be consolidated.

- We saw 51K mentions over the last year related to their collaborations with professional athletes or Major League Soccer (MLS) – the majority were about flavor and consumption experiences.

- Brand has a long history with high profile partnerships and investors – Naomi Osaka (Tennis), Megan Rapinoe (USWNT), Trae Young (NBA), Jennifer Lopez, Carrie Underwood, and more.

- Majority of their Instagram social content comes from this style of collaboration at all levels – household names to rising stars in sports.

- While they’re the “Official sports drink” of Major League Soccer, the volume of mentions tied to this is low.

- There is a clear opportunity to merchandise this more through content and activations on the Body Armor and/or MLS channels.

- Body Armor has also started to leverage college level athletes, like gymnast Livvy Dunne, within their broader marketing strategy, likely focused on reaching younger audiences. In another piece, Dunne does a stitch with one of the brand’s biggest ambassadors and investors, Jennifer Lopez.

It’s worth mentioning how this brand does an excellent job of celebrating all sports – from football to NASCAR racing to basketball trick shots and more. This comes through on social media when they feature everyday consumers in their content – making fans feel as important as Olympic athletes. In doing this, Body Armor continues to genuinely build community with an audience who prioritizes movement and active lifestyle (no matter how).

PRIME’s popularity is heavily associated with their widely known co-founders, Logan Paul and KSI. Announced and available in January of 2022, the brand is less than two years old with an immense following in the US and UK.

- There were close to 100K mentions on PRIME in the last year about their Ultimate Fighting Championship partnership or recent Super Bowl ad. Thematically the mentions were still more about Paul and KSI.

- Brand heavily relies on the social following of its co-founders, with almost all recent Instagram content featuring them.

- This raises the question of how successful PRIME can be when focusing on the product or sports industry vs the founders.

- Partnerships with Premier League team Arsenal, and most recently, the Dodgers indicate the want to drive awareness with older audiences.

Recent observations show PRIME’s most engaged audience skews on the younger side. This is tied to the brand’s dependency on their founder’s internet fandom, especially on platforms like YouTube and Instagram. Over the last year, it seems PRIME’s strategy seems to be aimed at rapidly earning as many shiny moments as they can. Does that nod to Logan and KSI hoping for a purchase and exit scenario?

Pickleball: A Pretty Big Dill – one of the fastest growing sports in the United States

Ideal for medium to large size budgets trying to reach engaged and active audiences

With sponsors like Skechers and Carvana, it’s clear that brands are seeing the potential reach that comes with the fastest growing recreational sport in the United States. 2020 was also a big contributor as people were more intentionally spending time outdoors and trying to stay active in new ways.

- Over the last 6-9 months, more notable personalities and celebrities, like Mark Cuban and Lebron James, have announced their investment in professional pickleball. This heightens awareness of the growing sport, even with spectators.

- There’s a strong social element to pickleball that’s likely helped with the growth in play, which could indicate potential opportunities for branded group activations.

- Private businesses have sprouted up all over the country offering spaces to play for a fee since popularity has caused issues in court availability. Brick & mortar locations can create new areas for sponsorship or advertising.

- Chicken & Pickle in Texas, Indiana, Arizona, Nevada, Missouri, Oklahoma, and Kansas.

- Dreamland in Dripping Springs, Texas – who recently announced a revamp to focus the business on pickleball.

- Pickleball-focused media, like The Kitchen, properties are growing rapidly and provide another area for partnership, especially during the growing amount of live events.

- Global potential is also high with this sport as it has become synonymous with tennis and padel across Latin America and Asia.

Deeper dive: When we looked at general pickleball conversation over the last year, we saw 1.25M mentions and the topic trending upwards in Google search. The growing popularity was boosted during the COVID-19 pandemic, where pickleball proved to be an accessible sport for many who were spending a lot more time outdoors.

We compared this volume of conversation with pickleball conversation specific to sponsors of Major League Pickleball (MLP) and the Professional Pickleball Association (PPA). We saw a much smaller number of mentions vs the general pickleball conversation. Majority of sponsorships occur at events, leaving brands to figure out how to be extra memorable on-site then how to keep the engagement going through digital touch points.

When evaluating a potential partner, consider starting with a mental exercise using the questions below…

- How does this brand or personality’s community best align with my target audience?

- Could this partnership reach a new audience or does it reaffirm your brand’s commitment to an existing audience?

- Does this partnership bring new ways to partner or create content?

- How can this partnership impact primary and secondary marketing touchpoints?

- Is this partnership best for short-term or a longer engagement? What makes it ideal for the long-term?

Stay tuned for more on sports partnerships and how to get the most from your investment.